Money laundering is a procedure that involves several stages, each created to obscure the origins of illegally gotten funds. For services, understanding these stages is vital to executing reliable anti-money laundering (AML) strategies. By identifying the 3 primary stages-- positioning, layering, and integration-- companies can secure themselves from becoming tools for financial criminal activity.

The placement stage is where the launderer first presents the illegal money into the financial system. This is typically the most susceptible stage for wrongdoers, as it involves the initial attempt to camouflage the source of the funds. Typical tactics include depositing big quantities of money into bank accounts, purchasing high-value possessions like automobiles or art, or utilizing money to gamble in casinos. For companies, particularly those dealing with cash or high-value goods, keeping track of big or suspicious deposits is vital. Policies such as reporting deals over a particular limit can assist recognize cash laundering tries early in the process.

In the 2nd phase, called layering, bad guys aim to conceal the origin of their money by moving it through complex financial deals. This may include moving funds in between several accounts, utilizing offshore banks, or buying financial instruments. Layering is designed to create a confusing trail that makes it difficult for authorities to trace the cash. Banks and other organizations need to utilize sophisticated transaction monitoring systems to spot unusual patterns or activity throughout this phase. Regular auditing and compliance checks can help businesses area disparities that could indicate layering.

The integration phase is the last step in the money laundering process, where the "cleaned up" money is reintroduced into the genuine economy. This phase frequently involves criminals utilizing laundered money to make big purchases or investments, such as real estate, high-end products, or company shares. At this moment, the cash appears legitimate and can be invested or invested without raising suspicion. Businesses dealing in high-value deals must be especially careful during this phase. Performing due diligence on big transactions and understanding the source of funds can assist prevent organizations from unwittingly assisting in cash laundering.

Each stage of cash laundering presents unique obstacles, but organizations that are proactive in understanding these phases can better protect themselves. From recognizing suspicious deposits during the positioning stage to utilizing advanced tracking tools for layering, companies have a duty to execute robust AML practices. By acknowledging and attending to the risks at each stage, business can avoid being caught up in prohibited financial activities and guarantee compliance with AML regulations.

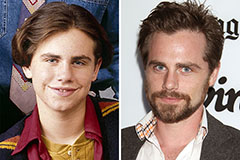

Rider Strong Then & Now!

Rider Strong Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!